As customers migrate more of their search and spending behaviors online, companies are following them. Results from the August 2015 CMO Survey indicate that companies expect to increase spending on digital marketing 12.8% over the next 12 months, while traditional advertising lags with a negative growth rate of -2.1%.

Produced by Duke University in partnership with the AMA and McKinsey & Company, The CMO Survey polls U.S.-based marketing leaders at for-profit organizations across all industry and economic sectors. The Survey has been fielded twice each year since 2009 in an effort to predict the future of markets, track marketing excellence, and improve the value of marketing in firms and in society. The latest findings, generated from the responses of 255 senior marketers, suggest that many companies may not be maximizing their opportunities to learn about online customers. In these early days of the digital learning race, this stance may put them at a considerable disadvantage.

My conversations with marketing leaders indicate a tendency to think that learning about online customers requires online methods, but customers don’t live their lives online—or at least most don’t. Offline experiences have important influences on customers’ online behaviors, and many offline behaviors, needs and other contextual influences can’t be inferred from online activities. Therefore, customers’ offline experiences also should be studied when marketers are looking to analyze and interpret online customer behavior. Only one-third of companies that responded to the survey have adopted this approach.

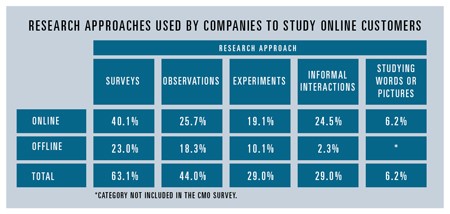

The CMO Survey asked marketing leaders to indicate all of the approaches that their companies use to learn about how to acquire, engage and retain online customers. Overall, 52% of companies are using at least one of the online research tools to learn about online customers, while only 37.3% of companies are using any of the offline approaches. In addition, 14.1% of companies report using no research tools to learn about online customers.

Surveys continue to be the most predominant approach for learning about online customers (63.1% of companies) followed by observations of customers (44% of companies). The fact that so many companies are using these tools suggests that companies are still in the mode of developing theories and ideas about online customer behavior. Surveys can help companies gain an understanding of private customer behaviors that can be easily recalled and shared, while observations can be a rich source of other types of critical in situ insights. Although experiments are used in more online settings (19.1%) than in offline (10.1%) settings, experiments only consist of 29.0% of all digital learning. This number is likely to increase as more companies use their emerging understanding of online customers to design experiments to acquire and retain them.

Findings indicate that most companies tend to emphasize the use of online and offline research methods: Only 26% of companies use both online and offline research approaches to learn about online customers, while 18% exclusively use offline approaches and 41% exclusively use online approaches.

Online and Offline Research Methods Used by Companies to Study Online Consumers

Another way to analyze these research methods is to ask if companies are using different types of specific research tools, such as online experiments and offline surveys, or online experiments and offline experiments. Analysis of the patterns of tool use indicates that of those companies using more than one offline or online tool, 78% are using different tools while 22% are using the same tool.

My own view is that the multi-method and multi-tool approaches nearly always provide better insight. This view is driven by the fact that all research methods and tools have their inherent limitations: Experiments answer focused questions and often sacrifice external validity while observations expose the researchers to a richer context but often sacrifice causation. Given these limitations a multi-method approach will likely allow companies to fill in the gaps presented by any given approach. Furthermore, in what I’d characterize as a “learning race” among companies to get the best online customer insights first, it’s fair to say that there may be value in going after insights from all corners in order to ensure that your company is not left behind.

Christine Moorman is director of The CMO Survey and the T. Austin Finch Sr. Professor of Business Administration at Duke University’s Fuqua School of Business. To access recent and archived findings from The CMO Survey, visit CMOSurvey.org/results.